Tripping Along the Razor’s Edge

Servicing technology in people’s places of work and life can make for some interesting memories. While I mostly remember things, places and activities there are times when the people (and pets) themselves stand out. Not always in the best possible light, sometimes it’s comedic, sometimes it’s bland and sometimes it’s downright frightening.

Being the “The Tech Lady” often meant tripping along on the razor's edge between the lines of comedy and tragedy, where each doorbell ring unveiled a new stage in the theater of human psychology. Some days, I would find myself reveling in the warm spotlight of joy; other times, I felt thrust into shadows that made my skin crawl.

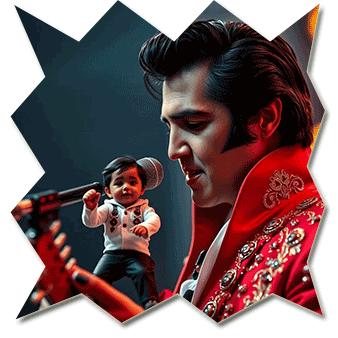

One of my fondest memories was the unexpected Elvis impersonation duo. Their home is the place where rhinestones catch in the afternoon light like tiny disco balls scattered around. The place where a father and son duo transformed their living room into Graceland-in-miniature, their matching jumpsuits a testament to dreams passed down like precious heirlooms. The boy, barely tall enough to reach the kitchen counter, already mastered the signature lip curl, his innocence wrapping around each "uh-huh" like a tender embrace. Elvis lives! In their world, every moment was a dress rehearsal for happiness. One of the most adorable acts I’ve been “graced” with seeing.

Just down the street, in a house where laughter took a different tune, a four-legged comedian with a sensitive tummy provided unexpected entertainment. This little dog, a master of unintentional humor, had learned to associate certain sounds with its own symphony of gastric adventures. Each raspberry sound I made sent its head swiveling toward its rear end, like a furry compass pointing south, its expression a mixture of recognition and resignation. Sometimes the simplest things bridge the gap between species – even if that bridge is built on shared bathroom humor.

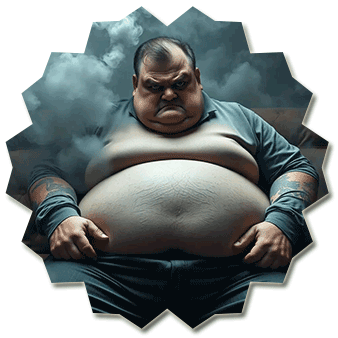

Then there are the homes where darkness lurks behind drawn curtains, where tension hangs thick as fog. The office became a cramped theater of threat, with a husband's presence filling the doorway like an eclipse blocking out hope. His knife was drawn, meant to rip open a small box, but instead became a conductor's baton directing a symphony of fear inside of me. Waving his weapon at me, his voice and the overall emotion in the room turned frightening. His wife, a reluctant actress, performed her steps of submission with practiced precision, her nervousness a trembling melody beneath the surface. I felt so bad for her and hope she was alright after I fled.

In these moments, when the air grows thick with threat and the exit seems miles away, you learn that some shows aren't worth staying for. Some shows only deserve a quick and quiet exit. Sometimes the bravest act is simply knowing when to lower the curtain and walk away, letting your footsteps echo down the street like a drumbeat of survival.

Every door has a threshold to the unknown – laughter, fear, celebration, or survival. We carry our tools in bags made of canvas and hope, never quite knowing if we'll need a screwdriver or an escape plan. But that's the nature of service calls: each one a story waiting to be told, each threshold a boundary between worlds, each encounter a reminder that behind every screen and machine we fix lies a human tale, for better or worse.

I'm open to writing for your site, contributing a guest post, or being interviewed for your content. If you'd ever like to collaborate on anything at all, don't hesitate to reach out, I'd love to hear from you! For the price of a cup of coffee 🍵, you too can help support cybersecurity education for all. Be a winner in the fight against scammers, show your support.